Introduction to FX Analysis

If you want to understand movements in the Forex and cryptocurrency markets, learning about FX analysis is crucial. By analyzing market data and trends, you can predict potential changes in currency values. This analysis involves studying various factors such as economic indicators, geopolitical events, and market sentiment to make informed predictions on how currency values may fluctuate. FX analysis helps traders and investors make better decisions when buying and selling currencies, increasing their chances of success in these volatile markets.

Importance of Predicting Market Movements

Predicting market movements in Forex and cryptocurrencies is crucial for traders to make informed decisions. By accurately forecasting market trends, traders can minimize risks and maximize profits. Successful prediction allows traders to enter and exit trades at the right time, increasing their chances of making profitable moves. Analyzing past data and current trends can provide valuable insights into potential future movements, helping traders stay ahead of the game. Understanding the importance of predicting market movements is key to navigating the dynamic and volatile world of Forex and cryptocurrencies.

Fundamentals of Forex Trading

Forex trading involves buying and selling currencies to profit from their fluctuating exchange rates. It operates 24⁄7 worldwide, allowing traders to take advantage of market movements at any time. To succeed in forex trading, you need to understand essential concepts, such as leverage, margin, pips, and currency pairs. Leverage allows you to control a large position with a small amount of capital, increasing both potential profits and risks. Margin is the amount of money needed to open a leveraged position, acting as a security deposit. Pips are the smallest price movements in the forex market, with profits and losses calculated based on their change. Currency pairs, like EUR/USD or GBP/JPY, represent the value of one currency relative to another. Understanding these fundamentals is crucial for predicting market movements and making informed trading decisions.

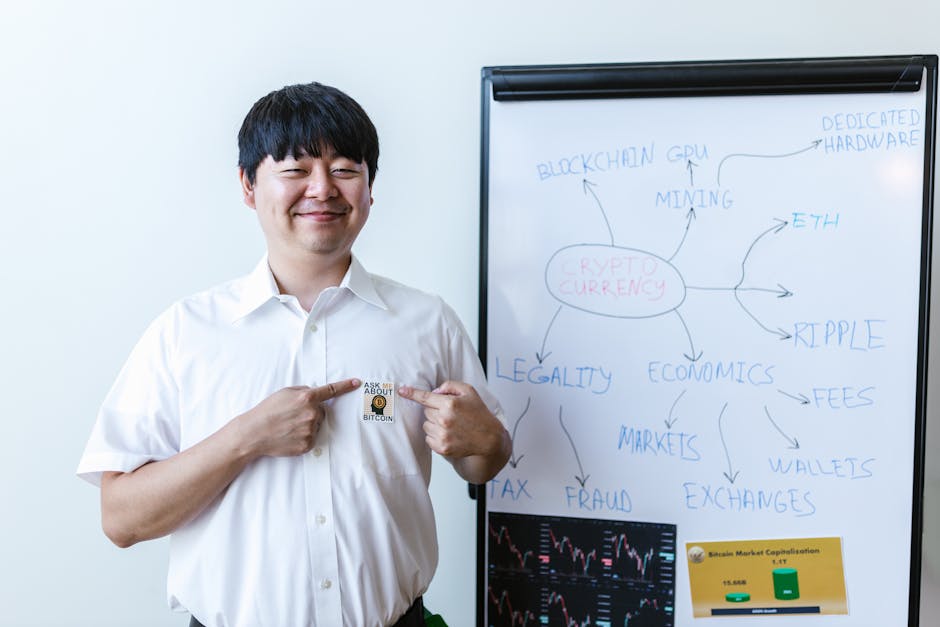

Factors Influencing Forex and Cryptocurrency Markets

To understand how Forex and cryptocurrency markets move, you need to consider various factors. Here are some key influences to keep in mind:

- Economic Indicators: Reports on employment, inflation, and GDP can heavily impact market movements.

- Political Events: Elections, government policy changes, and geopolitical tensions can sway the markets.

- Market Sentiment: Traders’ attitudes and emotions towards a currency or cryptocurrency can drive buying or selling behavior.

- Global Events: Natural disasters, pandemics, or other global crises can cause market volatility.

- Technological Developments: Advancements in trading technology or changes in blockchain technology can also affect market trends.

Understanding these factors can help you make informed decisions when trading in Forex and cryptocurrency markets.

Tools for Market Analysis in FX Trading

When analyzing the FX market for trading, several tools can help you predict market movements more accurately. Here are some essential tools to consider:

- Technical Analysis: This involves studying past market data to identify trends and make informed predictions about future price movements.

- Fundamental Analysis: By evaluating economic indicators and news events, you can gauge the overall health of a country’s economy and anticipate currency fluctuations.

- Sentiment Analysis: Monitoring market sentiment through tools like the COT report or sentiment indicators can provide insights into the market’s mood and potential direction.

- Chart Patterns: Recognizing common chart patterns such as head and shoulders, triangles, and flags can help you anticipate potential price movements.

- Indicators: Utilizing technical indicators like moving averages, RSI, and MACD can provide additional confirmation for your trading decisions.

By utilizing these tools in your FX trading analysis, you can strengthen your ability to predict market movements and make more informed trading decisions.

Technical Analysis in Forex and Cryptocurrency Trading

Technical analysis involves studying historical price charts to predict future price movements. Traders use indicators like moving averages, RSI, and MACD to identify trends and potential entry and exit points. In Forex and cryptocurrency trading, technical analysis helps traders make informed decisions based on market patterns rather than emotional reactions. It is a valuable tool for assessing market sentiment and understanding potential price directions.

Fundamental Analysis in FX Trading

Fundamental analysis in FX trading involves examining economic indicators like interest rates, economic reports, and political stability to predict market movements. These factors can influence the value of currencies in the Forex and cryptocurrency markets. By understanding the underlying economic forces, traders can make informed decisions about when to buy or sell currencies.

Sentiment Analysis in Market Predictions

Sentiment analysis involves studying market participants’ emotions towards an asset. By analyzing sentiment, traders aim to predict market movements based on the overall mood of the market. Key points to consider in sentiment analysis include:

- Social Media: Platforms like Twitter and Reddit can offer insights into public sentiment towards a specific asset.

- News: Monitoring news articles and headlines can provide an indication of market sentiment.

- Market Indicators: Keeping an eye on indicators like the Fear and Greed Index can help gauge market sentiment.

- Contrarian Approach: Some traders believe in going against the general market sentiment to find profitable opportunities.

Understanding sentiment analysis can be crucial in making informed decisions when predicting market movements in Forex and cryptocurrencies.

Intermarket Analysis for Comprehensive Market Insight

Intermarket analysis involves looking at different markets to gain a better understanding of how they influence each other. When analyzing forex and cryptocurrencies, studying various markets like stocks, commodities, and bonds can provide valuable insights. By observing these interconnected markets, traders can make more informed decisions and have a comprehensive view of the financial landscape.

Strategies for Predicting Market Movements

To predict market movements effectively in Forex and cryptocurrencies, it is essential to use a combination of technical and fundamental analysis. Here are some strategies to help you anticipate market shifts:

- Technical Analysis: Utilize charts and technical indicators to analyze past market data and identify patterns that may indicate future price movements.

- Fundamental Analysis: Study economic factors, political events, and market news to understand the underlying forces driving market trends.

- Sentiment Analysis: Monitor market sentiment through social media, news outlets, and trading forums to gauge the overall mood of traders and investors.

- Risk Management: Implement proper risk management strategies to protect your investments from unforeseen market fluctuations.

- Diversification: Spread your investments across different assets to minimize risk and maximize potential returns in varying market conditions.

By employing a combination of these strategies, you can enhance your ability to forecast market movements and make informed trading decisions in the dynamic world of Forex and cryptocurrencies.